Lend Money

Why Lend Money on Landingmarts?

In today’s environment where investments generates expected returns and most of our savings placed with institutions like banks goes into paying service charges to them, Landingmarts offers a unique opportunity to lend money and earn extra income on idle money.

The Landingmarts model provides better rates of interest than the traditional model because it removes the intermediaries and connects the lenders directly to the end users. Traditionally, banks and other financial institutions collect money through savings accounts or deposits like fixed or recurring at low interest rates (say 6-10%) and lend it to borrowers at much higher rates (18-36%).

Landingmarts brings borrowers and lenders directly in touch with each other, removes intermediary cost and enables lenders to make greater returns.

Lender Eligibility Criteria

Landingmarts is a mature, new-age financial instrument for discerning investors. It is for those who can go beyond conventional wisdom and traditional routes of investment to make independent and well-judged risk assessments. It allows Lenders to have greater control over their money and provides an investment route where they do not have to share their interest incomes with intermediaries.

We, at Landingmarts, seek to facilitate convenient lending opportunities for everyone. The platform provides the simplest and fastest method of registering as a lender, to anyone who is willing to lend. Our criterions are most basic and simple.

A Lender has to be :

- Indian Citizen

- At least 18 years of age

- Have a valid bank account in India.

- Have a PAN card

- Agree to abide by Landingmarts Policies.

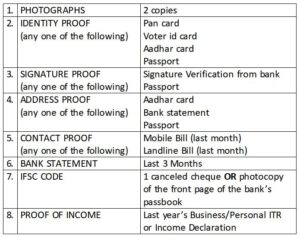

Documents Required to become Lender on Landingmarts

PROCESS

Lending money has never been so easy but Landingmarts have made it easier for you

Profile Creation

Firstly Register yourself with Landingmarts and complete your profile by filling up all the necessary information and attaching doucments required.

For that go to Profile ~ view Profile ~ add ~ ‘Fill up your details and attach the documents’ ~ update your Profile.

Approval/Evaluation

Once done with filling up all the details wait for atleast 24 hrs. We’ll verify your details and you will be notified and you will get a link through which your can start lending/investing money.

Agreement

Start lending/investing your money by agreeing to our Terms and Conditions. The minimum amount which a you can lend/invest is Rs.10000

Confirmation

Once you are done with the payment wait for sometime, you will get the confirmation mail from Landingmarts.

Earning

Whom you are lending your money?

Borrowers on Landingmarts are people who are credit worthy but do not want to pay high interest to banks; people who are smart enough to take charge of their borrowing, just as Lenders are people who want to take control of how they want to invest their idle funds.

Landingmarts provides a bouquet of borrowers with varying credit profiles who would be ready to give different rates of interest depending upon their need and credit worthiness. At Landingmarts, you can build a portfolio for yourself just the way banks do. We do not allow a lender to fund more than 20% of a borrower’s loan requirement. This is to encourage Lenders to hedge their risk by diversifying their lending portfolio and not put all their eggs in one basket.

Landingmarts has a strict listing criterion for evaluating each and every borrower before they are allowed to be listed on the P2P platform. Landingmarts physically checks their office and residential addresses, it verifies their income statements, payment capabilities, past performance in order to understand their ability, stability and intent. Landingmarts evaluates each borrower on more than 100 criteria across 300 data points which includes Financial, Professional, Social and educational background, loan records, etc. to cherry pick only the most eligible borrowers for Lender’s perusal. All such information about each borrower is shared on the borrower listing page so that an informed decision can be taken by Lenders.